Exploring the World of Debt Funds: How Private and Hard Money Lenders Leverage Them for Success

Debt funds have become an increasingly popular source of capital for private and hard money lenders in the real estate investment space. In this blog post, we’ll delve into the world of debt funds and explain how they work, their advantages, and how private and hard money lenders utilize them to finance lucrative real estate deals.

UNDERSTANDING DEBT FUNDS

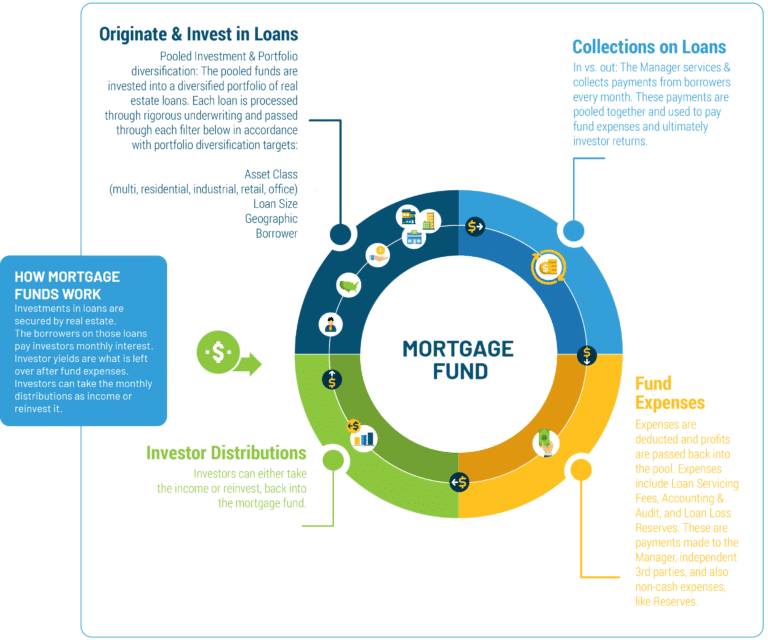

Debt funds pool capital from multiple investors, including institutional and individual investors, to provide loans for real estate projects. These funds are managed by experienced professionals who identify investment opportunities, underwrite loans, and manage the loan portfolio. By participating in debt funds, investors gain exposure to the real estate market without directly owning or managing properties.

THE ADVANTAGES OF DEBT FUNDS FOR LENDERS

Private and hard money lenders benefit from debt funds in several ways:

- Diversification: By tapping into debt funds, lenders can diversify their capital sources, mitigate risks, and gain access to a larger pool of funds for lending.

- Stability: Debt funds provide a stable source of capital, ensuring that lenders can consistently fund loans even during economic downturns or fluctuations in the market.

- Speed and Flexibility: With access to debt funds, lenders can quickly respond to market demand and offer competitive loan terms, including shorter loan durations and faster approval processes.

HOW LENDERS USE DEBT FUNDS

Private and hard money lenders leverage debt funds to finance a variety of real estate projects, such as fix-and-flips, ground-up construction, and commercial properties. They use the capital from debt funds to issue loans to real estate investors, who then use the funds to purchase and develop properties.

ATTRACTING INVESTORS TO DEBT FUNDS

To attract investors, debt funds must demonstrate a strong track record of success, solid underwriting practices, and an experienced management team. Lenders often showcase their investment strategy, loan performance, and industry expertise to persuade investors to contribute to the fund.

THE BENEFITS OF DEBT FUNDS TO REAL ESTATE INVESTORS

Debt funds benefit real estate investors by offering alternative financing options that are often more flexible and faster than traditional bank loans. Investors can secure funding for time-sensitive projects, which allows them to take advantage of lucrative opportunities in the market.

Debt funds play a critical role in the success of private and hard money lenders, providing them with a stable and diversified source of capital to finance real estate projects. By understanding the dynamics of debt funds and leveraging them effectively, lenders can stay competitive and agile in the ever-evolving real estate market. As an investor, it’s essential to stay informed about the financing landscape and consider how debt funds can benefit your investment strategy.